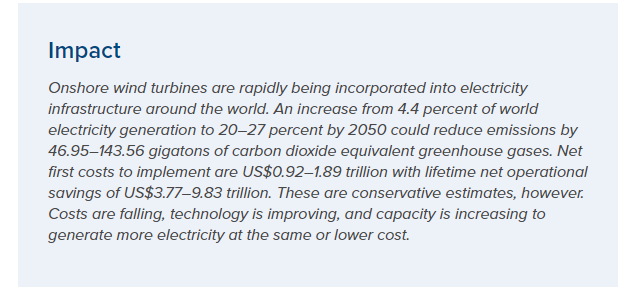

Project drawdown - onshore wind turbines as ONE solution to drawdown emissions

"Wind power plays a large and essential role in any long-term projections of a low-carbon future. It does not require mining or drilling for fuel, so its costs are not susceptible to fluctuations in fossil fuel prices.

One concern with wind electricity is intermittency. Wind speeds vary on a seasonal and hourly basis, requiring back-up power or storage at certain times to meet electricity demand and potentially investments and improvements in grid infrastructure and the flexibility of power systems. Both studies and real-world experience suggest these investments are manageable and cost less than fossil fuels when externalities (health and environmental impacts) are taken into account. Further, regions that do not yet have a centralized electric system designed around fossil use could easily design a flexible or distributed electricity system to take advantage of this resource.

Wind power capacity is projected to continue growing steadily with or without enabling climate policies. However, deployment could be accelerated by policies that put a price on carbon emissions, feed-in tariffs, renewable portfolio standards encouraging renewable energy use, public research and development to help advance the technology and further lower costs, and financial incentives such as production credits and tax breaks."

Onshore Wind Turbines | Project Drawdown

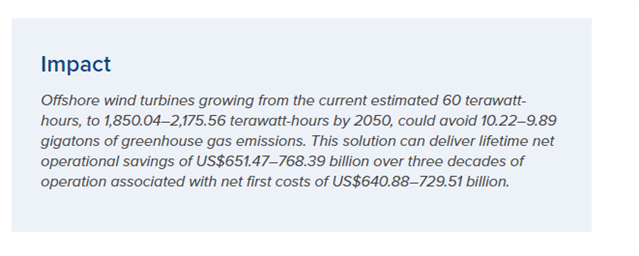

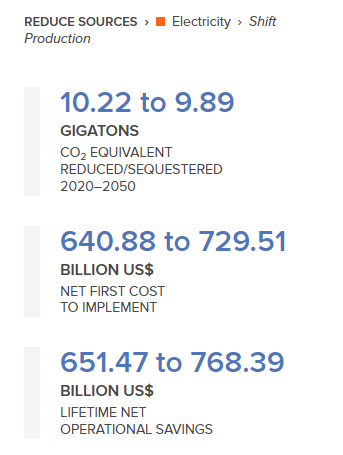

Project drawdown - offshore wind turbines as ONE solution to drawdown emissions

"Wind power plays a large and essential role in a low-carbon future: wind has large capability and is globally available, and the outputs of wind and solar are complementary in many regions of the world. Wind does not require mining or drilling for fuel, and its costs are therefore not susceptible to fluctuations in fossil fuel prices.

The growth of offshore wind could be aided by renewable energy and portfolio standards that mandate a certain level of renewable use. Wind developers could also benefit from regulatory stability, such as feed-in tariffs that guarantee a certain rate of return on wind energy and tax incentives that encourage investment by helping offset development costs. Public research and development can also help decrease costs, particularly for this immature technology. Technology knowledge transfer could help spread wind power across borders."

Offshore Wind Turbines | Project Drawdown

Going Green (Onward)

The Renewables Obligation and Contracts for Difference schemes have also encouraged investment in renewables, driving down the cost of wind and solar to the point that renewables are now the cheapest form of new electricity generation. (BEIS electricity generation cost report (2020))

Going Green Report from Onward (Think Tank ) - Going-Green.pdf (ukonward.com)

Octopus energy launches it's 'fan club' to discount unit prices when turbines are generating nearby

An interesting development I noticed recently was a discount if you're living near to a turbine

"Octopus customers living near our local fans can enjoy cheaper 100% renewable electricity whenever the turbines are spinning.

Join Octopus Fan Club and get:

100% renewable electricity from your local Fan!

20% off your unit rate whenever your turbine is spinning and you're using electricity

50% off your unit rate when the wind picks up and the green electrons are really flowing"

Introducing Octopus Fan Club: Local green energy for your home | Octopus Energy

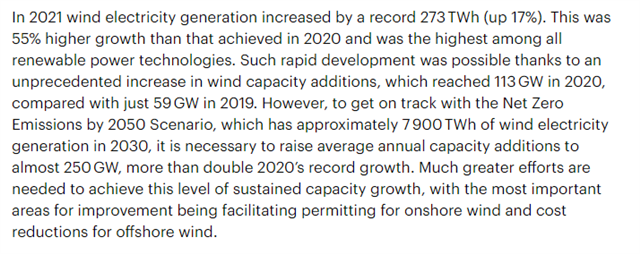

International Energy Agency Outlook on Wind Progress

There are challenges to be overcome though, more so in the areas surrounding storage, which is where something like Power Potential from the National Grid could play its part.

Power Potential | National Grid ESO

Here's the close down report Power Potential (Transmission & Distribution Interface 2.0) project close down report (nationalgrideso.com)